FROM OUR PARTNERS

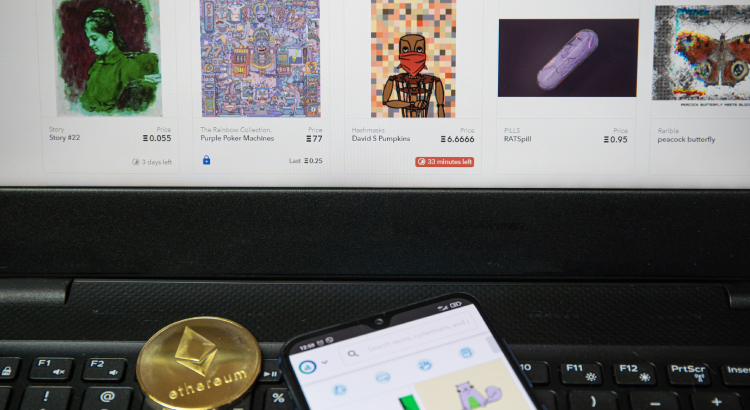

Cryptocurrency has already become a staple of everyday life — and new trends in digital finance and blockchain tech are constantly changing the playing field. Everyone is looking for the next big thing in the world of blockchain, and NFTs seem like they could be just that.

Non-Fungible Tokens are shaping up to be an excellent passive investment — everyone from huge corporations to individual celebrities and artists are considering creating their own NFTs. Even the gaming industry has taken note, with “play to earn” NFT-based games cropping up everywhere.

Everything points to NFTs rising in the near future as well. While the total global NFT sales were worth a respectable $250 million in 2020, during just Q1 2021 the number grew to an astounding $2 billion.

Naturally, as with any investment — not all NFTs represent an equally profitable opportunity. At the end of the day, they’re assets like any other, which means it’s more than possible to invest in the wrong ones. And that’s why we’re going to go in-depth on the process of making money with NFTs!

Making a profit with NFTs is definitely possible — but first, you need to understand what kind of asset this is in the first place. At its core, this is a non-interchangeable digital asset. That’s why they’re called “non-fungible” — a fungible asset is one that’s interchangeable with another. However, these unique data units are stored via blockchain technology that certifies the uniqueness of a digital asset, making it not interchangeable with identical copies.

And while some naysayers are pointing to the meteoric rise of NFTs in the past year as an inevitable market bubble in 2021, the public and the mainstream media are showing an increased interest in this kind of asset. Jack Dorsey, Twitter CEO and founder, famously auctioned the first tweet ever posted for almost $3 million — and donated the proceeds to charity.

Artists like Damien Hirst and Banksy have also caught onto the trend — and it’s only understandable. One of the downsides of digital assets has always been the ease of copying them. However, the technology behind NFTs ensures that a digital asset can be as unique — and thus, as valuable — as a singular physical object. So, while crypto skeptics view tokenized tweets as overvalued property, some artists and pioneers are making very real money off of them.

Naturally, just because NFTs can have immense value, doesn’t mean all of them necessarily do. With that in mind, how can you determine which NFTs are a valuable investment?

It’s no coincidence that a lot of artists were drawn to the concept of NFTs — unlike more structured DeFi protocols that allow you to value projects more easily, NFTs are far more subjective. Sentiment on these can turn on a dime — so it’s incredibly important to understand what you’re paying for if you want to determine its value.

If you’re buying digital art, the NFT isn’t the art itself. Rather, it’s the digital token that validates the uniqueness of that art — kind of like a certificate of authenticity. However, you still don’t have a physical copy of this art or even copyright on it — other people can still view or copy it.

Some people have likened NFTs to an artist’s autograph rather than the art, though that’s not entirely accurate either. Also, the blockchain on which the specific NFT is based also affects the prices. Users are more willing to pay top dollar for Ethereum-based NFTs, considering the decentralized and secure nature of the network.

As you can see, there are a lot of factors that influence the value of an NFT — which is why you should familiarize yourself with major value drivers.

Considering how different NFTs can be — from collectibles, virtual land, music, and art to in-game items — it’s important to realize that all of these categories come with different value drivers.

For instance, the value of an NFT art piece comes mainly from the artist’s reputation — while in-game assets generally derive value from their practical usefulness. An in-game sword that hits ten times harder than an average one will, logically, be more valuable.

Of course, there are some common value drivers — such as uniqueness and scarcity. Still, the art scene is probably the easiest one for NFT newbies to get into and understand. Things run intuitively there — as more renowned artists that have more fans will sell their pieces at higher prices.

Generally, anything that was very obviously made as a quick cash grab by otherwise uninterested artists and desperate celebrities is a red flag — let’s just say that a Lindsay Lohan NFT probably won’t rise in value over time.

Of course, just like with real-world objects, there are plenty of malicious sellers out there. Plenty of artists have been outraged by the prospect of their art being “stolen” and sold via Rarible or OpenSea after being tokenized through tweets.

The fact of the matter is, minting NFTs is extremely simple right now — making auctions on stolen goods a frequent occurrence. And when it comes to blockchain gaming, it’s important to see through the flashy marketing to the core of the game — if it’s devoid of substance and is being propped up by hype, it’s not going to be a long-term prospect for investors.

Looking to make a profit on NFTs is an understandable venture — but solely being in it for the money will, in the long run, almost surely result in zero gains. On the other hand, collectors that have a genuine love and interest in one type of NFT goods will have the upper hand long-term. Every NFT niche is different, and understanding the subtle nuances of the one you’re investing in is essential.

While the market as a whole is here to stay, it’s still very much in the experimental, speculative phase of development. There are all kinds of collectibles that seem valuable — but focusing on the ones you’re actually interested in and know something about is the best way to go.

Gauging the true ROI potential for NFT assets is more of an art than a science right now — and when you’re buying something, it should be a collectible you wouldn’t mind having for the foreseeable future. It could be five years before value drivers like utility, aesthetics, desirability, and scarcity push the price high enough for you to see a profit. And even if that NFT niche goes down — you’ll still own something you don’t regret buying.

Some artists and financial wizards think the NFT market is filled with overvalued property. And while the initial excitement over the entire NFT concept is likely driving prices higher than they’d be realistically in a stable market — it’s not certain if NFT truly is a bubble.

The fact that NFTs deal with digital-but-tangible assets means the sector is not as immune to regular market cycles as the other niches in the crypto space are. However, there are NFT sectors that could be undervalued right now as well — such as gaming.

Among all of the different NFT subcategories, in-game assets have the highest utility — making them potentially the most stable kind of NFT asset. Especially if you’re looking at NFT as an investment, it’s probably a good idea to look for assets that have underlying practical utility.

For instance, NFT crates for F1 Delta Time — a blockchain-based racing game with the Formula One license — that were sold for $500 just two years ago are now worth up to $60,000.

As you’ve likely realized by now, gauging the longevity and value trajectory of an NFT asset is what it’s all about — which is why understanding secondary sales is essential. It’s the true test of how high an NFT price can go beyond your initial purchase price — and whether it was worth that to begin with.

Collectors that take the time and energy to learn community-created or third-party market analysis tools are far more likely to correctly estimate the long-term value of their assets and make a sizable profit.

Conversely, not paying enough attention to secondary sales is the easiest way to end up holding an overvalued asset whose price just ran up in a short time — and is now set to slowly fizzle out.

If you’re really serious about winning auctions, taking a game theory course is a great idea — as is using bots and learning some lite coding. However, in many cases, avoiding the “game” altogether is your wisest course of action.

For those buying art, preempting the entire auction is likely to net you the most value for your money. Finding an artist on Instagram or Twitter, DMing them, and negotiating directly will almost certainly result in lower prices.

Artists that produce truly valuable NFTs don’t just consider the money either — they like knowing that the art collector who’s buying their stuff really appreciates it, and they like knowing who they are. Making virtual friends and striking up a casual conversation is your best chance to net something super rare.

The starting budget you need for NFT investments depends on what categories you’re interested in — though a few hundred bucks is reasonable for most NFT niches. However, considering the rising interest in NFT-based art, that kind of investment may require a few thousand dollars, at least for the most valuable one-of-one editions produced by a reputable artist.

Finding art bargains is the road for those with lower budgets — although that will obviously be harder. There are people, however, who specialize in discovering up-and-coming NFT artists and buying their art at a bargain.

Still, that is very much a long-term, uncertain investment that rests on your personal taste and the belief that specific artists will become immensely popular and valuable. However, hunting for artists that haven’t made a lot of NFT sales yet but have a lot of online followers on social media is probably a good idea — they’re the most likely to be discovered.

When it comes to gaming, the price gap is quite wide. NBA Top Shot common packs sell for as low as ten bucks, allowing crafty collectors to turn a small investment into huge profits.

At the end of the day, it starts just like any other research — with a general Google query. Of course, that will eventually trickle down to some more niche NFT news sources — like The Defiant, Bankless, Delphi Digital, etc.

Generally, it’s a good idea to follow NFT-dedicated accounts on social media, especially on Twitter. Make sure to follow Linda Xie, DCL Blogger, WhaleShark, and the experts they interact with. And if you’re going to get into NFT gaming, finding the right Discord communities is a must. There are plenty of NFT podcasts out there too.

In the end, bear in mind that NFT is an emerging market — which means that it will develop in unforeseen ways in the future. A lot of caution is necessary, especially if you want to get into the bull market that exists now. Large gains are possible — but so are huge losses, so be careful with your money. Don’t invest anything you’re afraid of losing.